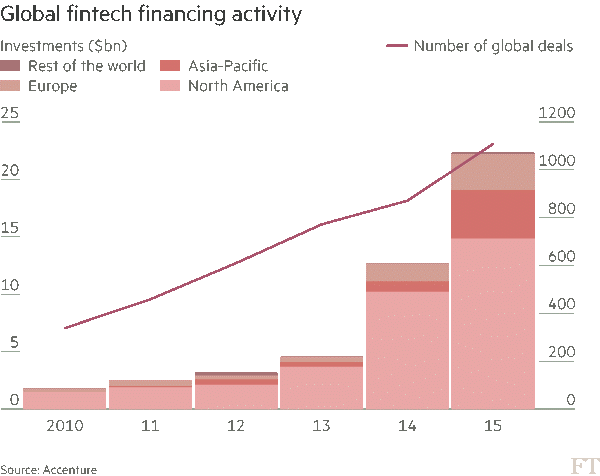

Several industries around the globe are facing the impacts of technological changes and the financial services industry is one of them. Consequently, the digital transformation in the sector of capital markets has even received its own term, called “FinTech”. FinTech refers to new technological innovations in financial services and has seen a rapid growth as the graph below shows (Forbes, 2020).

In this new digital era, banking has become faster and more convenient than ever. Not long ago, customers had to visit the bank itself or make long phone calls in order to transfer money or open a new account. Whereas invoices today can easily be paid online, money can be sent to individuals all over the globe and credit cards can be ordered by a few clicks on a smartphone.

Taking a closer look on how processes have changed throughout technology, customer service is a great example. A good customer service is essential for any firm involved in finance. In the past, employees were trained in order to provide assistance for customers. However, technology has made it possible for customers to interact with the bank throughout chatbots. These chatbots are possible because of artificial intelligence and does not involve any human touch (Vatbox, 2020).

Has online banking evolved into being something essential in today’s world?

Banking was traditionally done in a non-virtual world, where customers would go to their bank and interact with staff to sort out their finances. Nowadays the possibilities to access bank accounts are endless and can be done via phones, tablets and computers.

Lastly, fraud identification plays a significant role in the banking industry as well. It used to be a big effort for banks, since individuals had to investigate information to determine any potential fraudulent transactions. At present, artificial intelligence makes it possible to detect fraud and identify it in seconds. Systems are able to track previous patterns and hereby predict the likelihood of fraud.

The just mentioned examples are only a minor part of the improvements banks have seen through technology. In fact, outlooks suggest that the financial service sector is one of the industries that will face the highest changes in terms of digitalisation.

Specialised skills

Overall, it can be said that the transformation from banking into a digital space has had a positive impact on both firms and customers. As digitalisation overtakes the sector of financial services, so is the importance of specialised skills of staff increasing? Several banks acquire Fintech companies or reach out to consulting companies to support them in the integration of digitalisation in their future strategy.

When banking moves into more technological activities, the differentiation between financial services and technology becomes smaller. Traditional customer-facing jobs used to require a different skillset than considering the job of a banker at present. Artificial intelligence is replacing skills that are becoming irrelevant throughout this transformation and as a result banking and technology collide (efinancialcareers, 2020). This digital disruption in finance create new jobs, change existing jobs and some even disappear completely.

Since banks are aiming to automate work wherever they can, the number of traditional finance jobs are decreasing, whilst on the contrary new job roles are evolving. Financial institutions are in demand of highly technical skilled staff to maintain their integrated digital processes and to further exploit the opportunities it brings.

Future outlook

Since there is no end in sight of the ongoing revolution in financial services, HSBC even suggests a number of new jobs necessary to succeed in a digitally evolving financial industry. In the future, banks are on the hunt for staff with a digital mindset of skills, specialised in digital applications such as algorithmics and virtual reality (HSBC, 2020).

It cannot be denied that machines and artificial intelligence will continue to take on processes in the future, but the advantages of automation should not be underestimated. Instead, more emphasis should be set on human intelligence that include qualities such as empathy, curiosity and creativity.

In order for both financial institutions and employees to succeed in the future of a digital-enabled financial service industry, it is essential for employers to upskill their employees to prevent a shortage of skilled candidates. At the same time, employees must commit to lifelong learning and understand the importance of a digital mindset.

References

10 Banking Trends For 2020: Stormy Weather Ahead. (2020). Retrieved 13 February 2020, from https://www.forbes.com/sites/alanmcintyre/2020/01/09/10-banking-trends-for-2020-stormy-weather-ahead/#1836bfd81c06

Banking and finance professionals must update their skills as the industry faces digital disruption. Retrieved 13 February 2020, from https://news.efinancialcareers.com/sg-en/3001122/banking-and-finance-professionals-must-update-their-skills-to-remain-competitive-as-the-industry-faces-digital-disruption-sc

How Technology Affects Jobs in the Financial Services Industry. (2020). Retrieved 13 February 2020, from https://vatbox.com/technology-affects-job-in-financial-industry/

HSBC highlights the six new banking careers of the future. (2020). Retrieved 14 February 2020, from https://www.finextra.com/newsarticle/32355/hsbc-highlights-the-six-new-banking-careers-of-the-future

As for the FinTench mentioned by the author, I know a little bit in the past. So I am very interested in this blog.

With the rapid development of big data and cloud computing technologies, fintech has also profoundly affected the financial industry. In the future, the basic business of a bank should be as “modular” as building blocks, and financial services can “patch up” business modules according to specific needs, increasing business diversification and customization. At the same time, banks will become a highly open and shared financial service platform. Fintech companies and banks together form a coexisting financial ecosystem. However, the practice of open banking in the real sense may face certain challenges and should not blindly follow the trend and chase hot spots. In the long run, banks should base themselves on the reality, try new business models, and gradually improve the system architecture and cultivate core capabilities.

LikeLiked by 1 person

Thanks for sharing this. As someone with no active interest in finance, it’s interesting to see how technology is applied to industries like this. I get so used to just having my banking app on my phone and being able to check it whenever I like. I also use stock-trading apps to look at share-prices when I hear about companies in the news, even though I don’t hold shares! Digital tech has given me more access to financial and banking services than I actually realised.

One question. You’ve mentioned a lot of tools that help the industry operare more efficiently (fraud detection tools, development of chat bots). One thing you didn’t mention was cryptocurrency. Do think this could have affect consumers in the coming years?

Thanks!

LikeLike

Hi! I really like how you have discussed the roles FinTech is playing in the banking sector. In most cases we see that the firms opting FinTech in their operations are financially stronger ones and operate on a larger scale (Telegrapgh, 2018). Banks are obviously

considered larger firms as well. What do you think about the FinTech implications in smaller or medium sized firms? I believe that for small firm it could be difficult to adapt as high operating costs due to multi-layered management systems could be a big challenge for them. I would appreciate if you could shed some light on this topic. Thanks.

Also here is an interesting article related to the topic you might be interested in:

https://www.bbc.co.uk/news/uk-scotland-scotland-business-51051029

LikeLike