When I first choose this module, I was not quite sure what to expect. I had never comment on any blog before, not even to think about setting up my own. Reading blogs and posting comments, have not only given me insightful knowledge on various topics around digitalisation, but also many more advantages. I believe it is a great way to create a connection with people who share similar thoughts, but also an opportunity to see topics from a different perspective. I summarised my thoughts on blogging and commenting below:

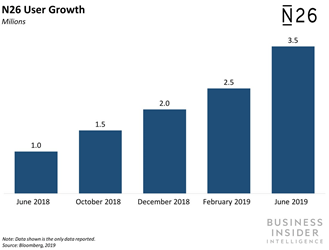

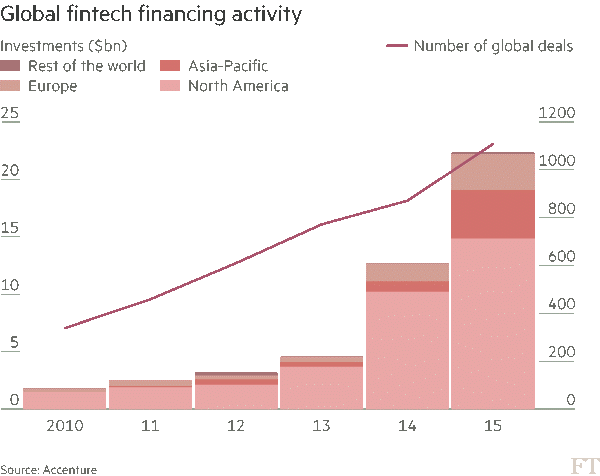

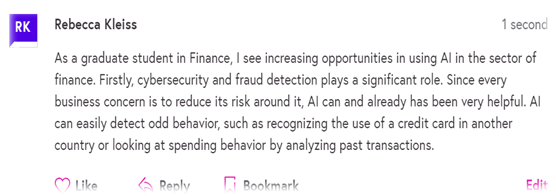

Since I am completing a master’s in finance, I mainly read blogs that sparked my interest and enhanced my knowledge in this area. I shared my thoughts in this regards to one article about the usage of Artificial Intelligence published on the future learning platform MOOC:

Digitalisation in the workplace

Further we discussed the impact of digitalisation on different job roles and its implications. I here found Kristy’s blog post on the changing role of a management accountant especially interesting. She makes a very good point by describing how the demand for accountants will decrease, but I also added my thoughts on the increasing importance of being able to manage and analyse big data here and in the spectrum of digital transformation in retail here.

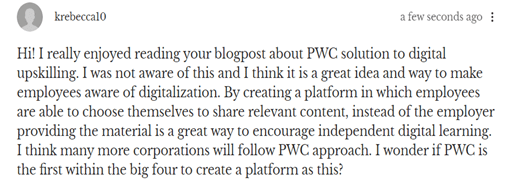

On the other hand, I found one great example by PWC on how employers can enhance digitalisation by engaging its employees on an internally created platform:

»»——————————————————-—-««

“Music (either played from records or streamed from platform) remains a large part of our society and culture.”

Besides reading content in topics of finance, the ongoing example of Spotify throughout the module was very interesting. I am a big fan of the music streaming platform and have been a customer since several years. Due to this module, I learned about Spotify’s digital business model, but also of new economic concepts such as the on-demand economy. Further I thought Tom’s thoughts on how digitalisation has affected musicians insightful. I realised that my freedom of being able to listen to music at anytime and anywhere has its downsides for the artists and shared my views here (user: kleissr). Moreover, I got the opportunity to read about the new viral content-making app TikTok and was able to engage by asking a question:

◣________________________________________________________◢

To conclude, it can be said that commenting is an effective tool to boost engagements on blogs. Comments serve several benefits, from grabbing the attention of the reader and other viewers, to providing the writer with feedback and appreciation. In my own case, I enjoyed receiving comments on my blog and see other students engaging in the same topic.

I now see blogging and sharing thoughts online as a tool to enhance learning, building better relationships online, and above all being digitally active.