The previous post was all about how the financial sector is shifting towards a more tech-oriented perspective and how FinTech is changing the world of banking by creating more customer-centric products. It is not a secret that high street banking is not what it used to be, and in the last five years around 3,000 bank branches have closed their doors in the UK (KPMG, 2019). With fewer banks on the high street and a growing FinTech trend, the doors have been opened to new entrants- Challenger banks.

What is a challenger bank?

Challenger banks are smaller banks which set out their business model in combining technology and software to digitalise commercial banking. These banks are independent and challenge traditional banking by using digital distribution channels to deliver their services.

The services offered include the same as with any traditional bank, ranging from current accounts to insurance opportunities. The major difference can be found within that the transactions happen at real time and there exist no physical retail locations.

Want to open an account on a Sunday night from your bed?

In the past opening a bank account could be a painful process: a visit in the branch was necessary to fill out several forms and eventually receive the bank card in up to 10 working days. However, the big five digital-only banks Atom Bank, Monzo, Starling Bank, Revolut and N26 make it possible to create a bank account within only 15 minutes. All you need is your ID; a smartphone and an internet connection- and you will be all set up.

Besides setting up an account extremely fast, the new fintech banks offer other benefits such as charging low or no fees at all. This is possible due to the low operational costs a challenger bank faces in comparison to traditional banks. Since these banks have no branches, they operate with higher margins resulting in better rates for us- the costumer (Moneywise, 2019).

A success story: N26

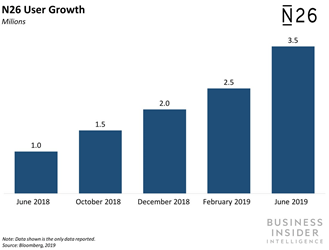

Being one of the most innovative and successful companies operating in the banking and finance industry today, N26 has gained more than 3.5 million customers in 24 European markets since its first launch in Germany in 2015. Today, their customers carry out 16 million transactions per month, which is around 400 transaction per minute (N26, 2019).

Founded by two Austrian entrepreneurs, N26 has its headquarter in Berlin, holds a full banking license and is one of the highest valued startups of Europe.

The company’s aim is “to become a full replacement for any other bank account in the markets we operate in” – CFO of N26 said (N26, 2019). The outlook is promising: in July 2019 the company was valued at $3.5 billion and their business is constantly expanding by entering new markets such as the US and Brazil (N26, 2020).

Is N26 as good as it sounds?

In my own opinion- yes! Being a customer of N26 myself I can highly relate to why challenger banks have become this popular and the rapid growing number of new customers.

My own major benefits of using N26 consists of being able to manage my savings better by setting up “spaces”. Spaces are subaccounts of my main account and can be set up in seconds. Last year I planned a trip to Indonesia, I set up a new space called “travels”, transferred my savings and froze the account- all in three clicks in the N26 app. I was not able to access the account till the day my trip started and once it did, I set a limit of my daily budget to keep better track of my spending. Would this have been possible with my traditional bank? No.

A further benefit are the low fees and transaction costs. Since I have been living in Sweden, Germany, the Netherlands and am now a student in Exeter, the UK, I have bank accounts in each country. This meant high fees and transaction costs whenever I transferred or withdrew funds. However, with N26 I benefit from low transaction costs and am able to withdraw free fee-cash worldwide ten times a year.

Summed up

The success stories of N26 and other challenger banks demonstrate that banking can be truly digital by purely relying on an app. Nevertheless, there remain big challenges these new FinTech banks will face, including security and technical issues (Ozcan, 2019).

However, with their roots in technology, the growing number of invested funds and their quick ability to integrate new innovations, it can be expected that challenger banks will find their way.

As a finance student pursuing a career in this industry, I am excited to be part of the rise of challenger banks and the types of updates and intelligent features we will see in the future!

References

Challenger Banks: Opportunities & Challenges. (2020). Retrieved 5 March 2020, from https://home.kpmg/uk/en/home/insights/2019/06/challenger-banks-opportunities-and-challenges.html

Challenger banks: the good, the bad and the different. (2020). Retrieved 5 March 2020, from https://www.moneywise.co.uk/savings/savings-accounts/challenger-banks-good-bad-different

Fintech Trends: Challenger Banking | finleap. (2020). Retrieved 5 March 2020, from https://www.finleap.com/insights/fintech-trends-challenger-banking/

Here’s how N26 is building a simple, flexible user-experience. (2020). Retrieved 5 March 2020, from https://n26.com/en-eu/blog/building-a-simple-flexible-banking-experience

Ozcan, P., Zachariadis, M., & Dinckol, D. (2019). “Platformification” of Banking: Strategy and challenges of challenger versus incumbent banks in UK. Academy Of Management Proceedings, 2019(1), 17147. doi: 10.5465/ambpp.2019.17147abstract

Very interesting insights Rebecca! As an individual who uses N26, Revolut, and Starling, it is useful to gain an understanding of the landscapes in which these companies work. There are countless ‘challenger banks’ emerging currently, all with similar functionality but slightly different interfaces. Due to the similar nature of their product offerings, do you believe that the industry is yet to undergo a period of consolidation, or, do you believe that these banks will continue to work independently; just like HSBC, Barclays, Lloyds, and Santander do? Alternatively, the large the traditional banks previously mentioned may see opportunity to bolster their tech capabilities through the acquisition of these companies. As you detailed, low fees and transaction costs are just some of the benefits that challenger banks offer; acquisitions by large banks may scupper these attractive offerings. All and all it is exciting to see how the world of banking and finance in changing within our lifetime, these disruptive companies make be the market leaders of retail banking in the not so distant future!

LikeLike

Very interesting read, had not heard of N26 until your article, neither any of the other big five digital banks except for Monzo (and that was due to their Youtube adverts alone). I think you spelled out very well the advantages that soly digital banks can provide not only for these companies in terms of higher margins but the convenience it brings to consumers. Nevertheless, do you think the lack of a physical presence (Physical evidence, one of the 7p’s for services) will serve as a hinderance to them acquiring more consumers?

Furthermore, your story about Indonesia and “spaces” in the bank was most fascinating and something I could definitely do with, however do you think more traditional banks will start using this technology as well to keep consumers, which might threaten the future growth of these digital banks?

LikeLike

This is an interesting post which demonstrates how Industry 2.0 has innovated the financial service industry. You identified that how through disruptive innovation, ‘challenger banks’ have emerged competing with the mainstream banks observable on high streets. It is exciting to see how much this industry has already been transformed by these challenger banks offering features on their apps which are clearly aimed at meeting the customer’s needs and improving their overall banking experience. Their digital business model permits them to operate at a much lower cost as they do not require a physical location. Mobile banking apps such as Monzo are particularly popular with younger demographics, although they are growing in overall popularity as mobile banking becomes more mainstream. You highlighted the innovative features of N26 which you benefited from. Do you think that traditional financial services must adapt to offer similar features within their mobile banking apps to compete with newcomers to the industry?

LikeLike

Hey. A very interesting read! Challenger banks is a completely new concept for me and I am pretty sure not much people would have heard of it. So first of all kudos for picking up an unusual topic.

After reading this post, I researched on the topic a bit further and now I have a few questions. It is stated in many articles that challenger banks have trouble in making profits, “The Wall Street Journal reports that Goldman Sachs has lost $1.3 billion since launching Marcus, their retail bank, in 2016.” (BBC, 2019) and yet the number of similar businesses in the industry are increasing. So how do you think the business of this sort sustains itself and what is the key factor that is attracting more and more people to step into this business?

From my perspective, it seems that such banks need large scale big investment for marketing and attaining more customers and later they manage to achieve economies of scale and their profits start to surge. Kindly elaborate if I understood correct or there is more to it. Thanks.

The following article helped me in understanding the profitability concept for challenger banks. I hope you will like it.

https://fincog.nl/blog/15/the-profitability-challenge-for-challenger-banks

LikeLike